cryptocurrency market analysis february 2025

Cryptocurrency market analysis february 2025

The key level to watch for PEPE is $0.00000633, which represents PEPE’s 38.2% Fibonacci level acting as a a critical support and potential rebound point https://betsoft-software.com/. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

The S.E.C. will open an investigation into Prometheum, the first so-called “special purpose broker-dealer.” The abrupt emergence of a previously unknown broker-dealer that happened to specifically agree with the totality of S.E.C. Chair Gensler’s views on the securities status of digital assets raised eyebrows in 2023, particularly when the unknown firm was granted the first of a new class of broker-dealer licenses. The CEO was berated before Congress by Republican members of the House Financial Services Committee, and according to FINRA records, Prometheum’s alternative trading system (ATS) has yet to conduct any trades. Republicans have called on the DOJ and SEC to investigate Prometheum for “ties to China,” while others have noted irregularities in their fundraising and reporting. Whether or not Prometheum is investigated, it’s likely that the special-purpose broker-dealer license is abolished in 2025. -Alex Thorn

Tether’s long-standing market dominance will drop below 50%, challenged by yielding alternatives like Blackrock’s BUIDL, Ethena’s USDe, and even USDC Rewards paid by Coinbase/Circle. As Tether internalizes yield revenue from USDT reserves to fund portfolio investments, marketing spend by stablecoin issuers/protocols to pass-through revenue will convert existing users away from Tether and onboard new users to their yield-bearing solutions. USDC rewards paid on users’ Coinbase Exchange and Wallet balances will be a powerful hook that will boost the entire DeFi sector and may be integrated by fintechs to enable new business models. In response, Tether will begin to pass through revenue from collateral holdings to USDT holders and may even offer a new competitive yielding product like a delta-neutral stablecoin. -Charles Yu

Cryptocurrency market analysis march 2025

CryptoPatel is a seasoned Technical and Fundamental Analyst with over a decade of experience in the cryptocurrency market. Renowned for his ability to identify high-potential Alpha and GEM projects, he has consistently delivered exceptional returns ranging from 10x to 100x. Follow for expert market insights, in-depth trend analysis, and valuable investment opportunities.

The future of cryptocurrency is a dynamic blend of innovation, adoption, and regulation. As Bitcoin’s growth in 2025 continues to lead the charge and Ethereum evolves, new technologies—especially AI-driven solutions—are set to redefine the landscape. While uncertainty remains, expert crypto market predictions for 2025 suggest the ecosystem is on the brink of significant change, offering compelling cryptocurrency opportunities for forward-thinking investors.

The 38.2% Fibonacci level of $0.24 will need to act as key support for bullish momentum to develop. Moreover, with great advancements on Stellar’s blockchain platform, from cross border payments to Defi and RWA, Stellar is fundamentally ready for a stellar year.

The creation of a bitcoin reserve by a major economy like the United States underscores the growing institutional acceptance of digital assets. This move is expected to influence global crypto policies and may encourage other nations to consider similar strategies, thereby enhancing the legitimacy and stability of the cryptocurrency market.

Throughout 2025, SUI is predicted to trade between $2.44 and $8.80 based on SUI upward revised price targets (Oct 12th). Key drivers: institutional adoption and technological advancements. If market conditions remain favorable, SUI could experience significant growth.

Cryptocurrency market trends march 2025

The Stacks long term chart looks bullish. It is printing a series of bullish reversal in the context of a long term uptrend. An acceleration point will be hit, sooner or later, presumably on BTC bullish momentum somewhere in 2025.

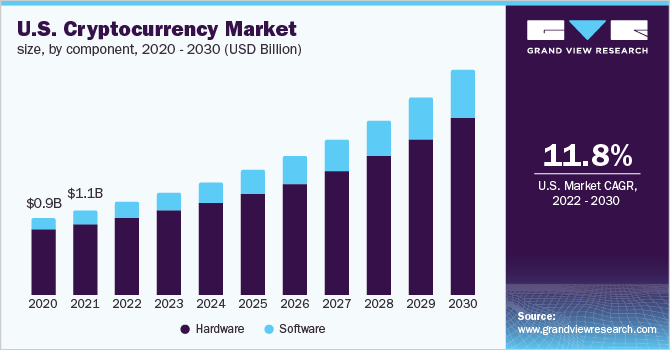

Spot crypto ETFs quickly became the fastest growing ETFs in history after their launch in early 2024, recording hundreds of billions in inflows and helping drive the price of bitcoin higher. In the US, 39% of crypto owners said they are invested in a cryptocurrency ETF, up from 37% in 2024.

President Donald J. Trump has embraced cryptocurrency by launching a Strategic Bitcoin Reserve, Congress is moving forward with stablecoin and regulatory legislation for digital assets, and corporations are adding more bitcoin to their balance sheets.

AI agents optimize results by autonomously adapting their strategies. Protocols like Virtuals already provide tools for anyone to create AI agents for on-chain tasks. Virtuals allows non-experts to access decentralized AI contributors, like tuners, dataset providers, and model developers, enabling anyone to create their own AI agents. This will result in a massive proliferation of agents, which creators can rent out to generate income.